It’s Summertime So Lets go “Sledding” with Education

In this installment, we are looking generally at the AV and Digital Signage opportunities and contracts in the current SLED Market. SLED is the acronym for State, Local, and Education.

It is a busy time for Education for sure with the new school year coming up in a few months. I would guess somewhere between 50,000 and 200,000 Chromebooks for example. Interactive whiteboards (75 and 85) are typically quantity 500 to 2500 per bid. By the numbers that is a $5B industry just by itself (1000 opps). Many schools are adding “touchscreen” as one of their qualifiers. And schools prefer the top tier “white glove” delivery equation.

For me most of my sponsors like 22Miles, Nanonation, LG and Panasonic for example are wanting me to track self-service, digital signage, digital displays, Point of Sale and Smart City (Mesa and Miami are taking bids for those right now).

EV Charging Stations is almost an entire sector by itself given the NEVI and the $6 Billion in funding going out later this year. The regulatory agencies are trying to catch up with that monster…EV extends beyond SLED to corporate and even consumer. What are the odds LG and Samsung offer EV Charging stations at Costco in next 12 months? Better than even odds I think.

Anyway after talking to my contacts at AVIXA I decided to widen the view abit and look at “AV related”. Its a huge market right now.

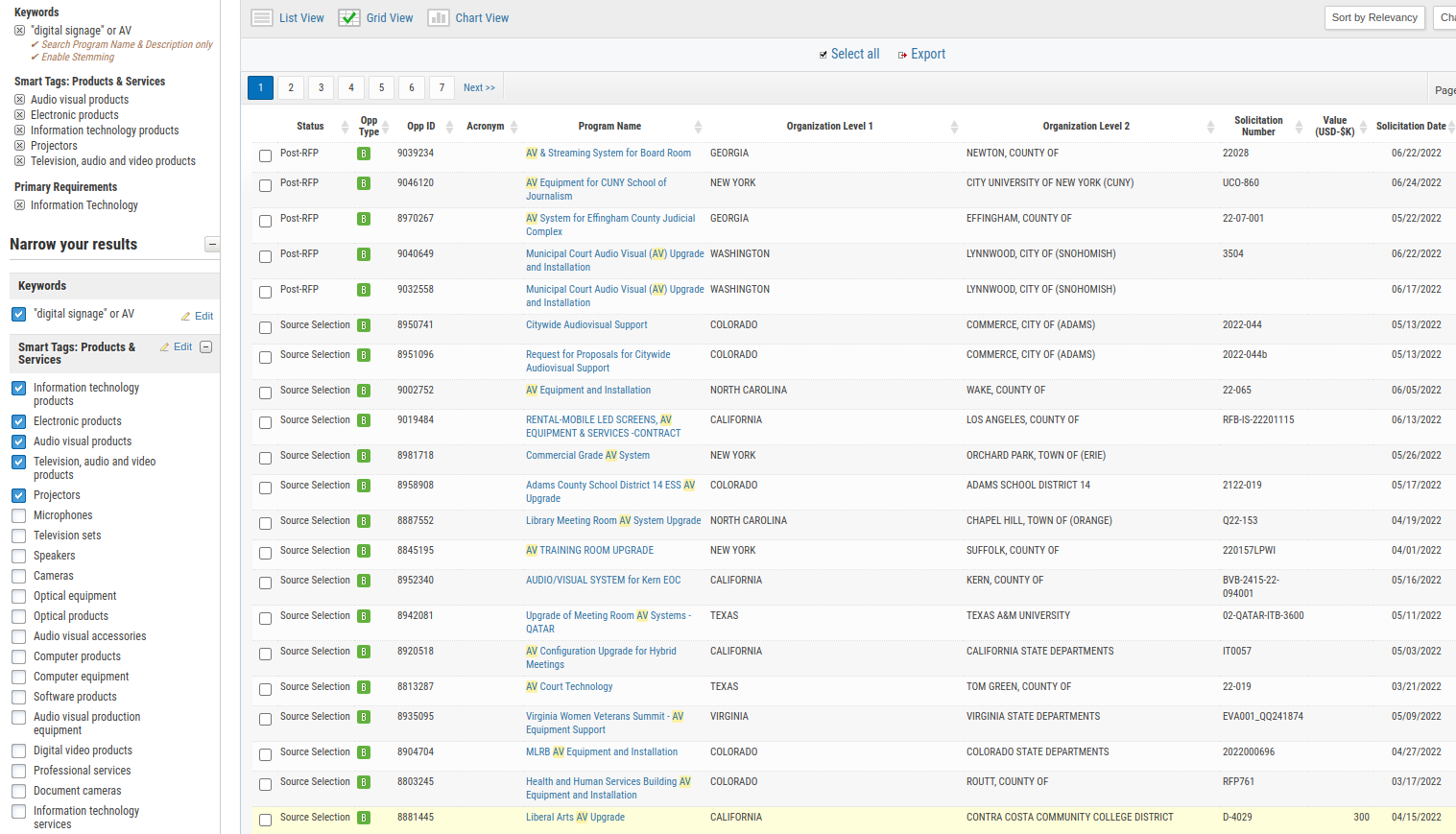

- 1,000 or so bids in the system right now

- About 60 in the Active, Post RFP stage

- Here in one of my services you can see the categories of AV for example

Breakouts for SLED

- Digital Signage -- $310M and 540 opportunities (200 contracts)

- AV - $14B and 4700 opportunities (3000 contracts)

- Kiosks $2B and 2480 opps -- (640 contracts)

- EV Charging $507M and 320 Opportunities (90 contracts)

- Smart City $306M & 175 opps (60 contracts)

- Point of Sale $380M & 1300 opps (452 contracts)

- Displays -- $123B & 25,000 opps (18K contracts)

- It’s tougher to break out installation, maintenance and delivery numbers though that is often part of the contract.

Contracts are of special note as they are multi-year (typically 5 year) and the gift that “keeps on giving” as we like to say in Sales. Typically high margin (70% profit?).

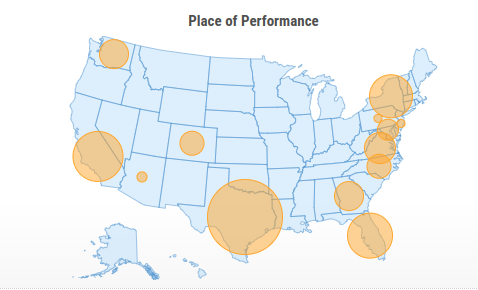

In the AV market, the leader in contracts is Unified AV Systems (50 contracts). Companies like CDW meanwhile are in the teens. Let’s take a look, geographically, where those contracts are coming from.

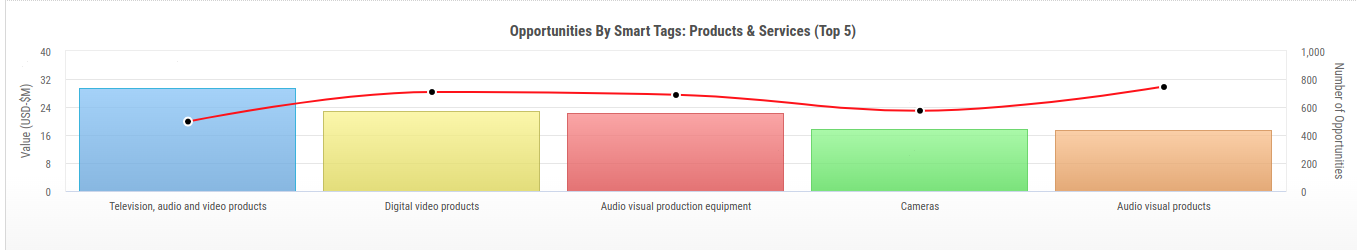

Everybody like charts and numbers, and ideally future numbers so they can adjust investment and budget.

These opportunities are predominantly Education and General Government Services.

Other Reports

It’s always good to sample what some other reports are saying (and what they said before I should add). There is the usual research market data “announcements” by data firms and resellers of those data firms. Usually the report originates from India and you can get 20 different numbers from the reports. Those are generally a function of Google trends where growing interest triggers the subsequent “maybe they will buy a report for $5,000). I actually track those numbers in the Kiosk Industry market report (v12). There are firms like Frost and Sullivan that are a step up. There was a new one I saw from Omdia last week looking at displays (LCD, OLED and direct-view LED video displays. Interesting as its analysts are generally in Asia (South Korea, Japan, Malaysia). Looks like $13B overall but this is their first report I think. Wait till they have done a few maybe. I'll check with LG in the meantime. FutureSource out of the UK is another reputable data provider when it comes to “screens’. Funny how that word still gets used.

Limitations of SLED and Education in particular

It’s a market for resellers for sure. Most mainstream providers don’t compete in the K-12 market space. Companies heavy on resources like LG, Samsung, Dell and HP being the exceptions. When the criteria is price, software, installation, and hardware in that order, the usual suspects won’t compete.

Regulatory Issues

State, local, education and federal are all subject to accessibility regulations and that ends up with agencies having separate RFPs for Assistive Technology later. The Trump administration issued an executive order that for every new regulation put in place, two must be eliminated. The net result was zero regulatory action. That has changed with the new regime (can I call it that?) and agencies such as the U.S. Access Board has already issued an announcement that it is going to issue regulations this year on kiosks, information transaction machines, Point-of-sale and EV Charging. Schools are already spending money to put in EV charging stations, some with big screens (there’s that word again…). Here is a complete wrap of all regulations-in-progress as of July 2022. One notable exclusion by the UAB is they are not going to do websites and WCAG. Too much of a moving target if I had to guess. And to be sure along with regulatory issues, there are legal issues as well that should be factored. Those generally turn up in Audio related issues. One of the last DOJ issues was regarding how accessibility and ADA cannot be delegated to the suppliers. Alabama tried that with temperature cameras.

Conclusions and Next Up?

My standard advice to my sponsors and members is to be a subcontractor to the companies which always bid these projects. Building and shipping is more fun than going thru sales and support ccyle. Towards that end I typically provide them with the list of bidders so they can contact them and be their supplier. Let that group do the selling and the support. There are large companies like Sharp for example which service sub-200K RFPs (see below for details published today actually).

We’ll collect comments and thoughts and I can do a deep dive into particular products and services in the next installment as warranted. If you have any suggestions or questions you can always contact KMA via email which is craig@kma.global-- many thanks to Joé Lloyd of AVIXA who helped steer me thru this process.

Bid Examples aka Real Life

I’ve listed some sample quotes (almost all still active by the way). It used to be a 6 month process but the pandemic accelerated the mechanisms to only and now it is generally 60 days. Not to say that that sometimes they take 2 years. There are those for sure.

Las Vegas

Bid Opportunity Information

Bid Number: 220216-JL

Bid Title: Council Chambers AV Design and Integration Consultant

Issue Date: 7/5/2022 03:00:01 PM (PT)

Close Date: 8/3/2022 01:30:00 PM (PT)

Bid Notes

The City of Las Vegas (City) hereby invites qualified firms or individuals (Offerors) to submit written proposals

for a technology consultant to create plans for a modern upgraded fully integrated audio visual system in the City Hall Council Chambers. Persons with a disability may request accommodations or assistance to participate in the solicitation process by contacting Purchasing & Contracts at 702-229-6231 or 7-1-1 (TTY). To insure the City is able to meet your needs, please submit requests at least 2 business days in advance.

Dallas DART - Submission due date of 7/15/2022

Los Angeles School District - Contract starts August 2022 (hopefully)

The scope of the contract is to provide AUDIO/VIDEO CONFERENCING DEVICES,

PROJECTORS (INCLUDING INTERACTIVE PROJECTORS), INTERACTIVE DISPLAYS, DOCUMENT CAMERAS, AND ACCESSORIES in accordance with all the terms, conditions and specifications specified herein.

Term is 36 months with addition 2 years optional.

Typical REQUIRED SERVICES

Contractor shall include the following services, the costs of which will be factored into the unit price submitted:

- Delivery of equipment

- Unpacking, removal of packing materials off-site

- Set up and integration of device in/on designated area

- Connect cables

E - Install and troubleshoot applicable software, device drivers, firmware updates, etc. and perform software conflict resolution

- Calibration of device if applicable

- Configure LAUSD WIFI with District provided credentials if applicable

- Test interoperability

- Ensure neat cable management to set up to eliminate clutter and prevent unintentional disconnection or damage

- Apply District approved inventory tag following all criteria outlined in Section

42 ASSET MANAGEMENT

- Preview the features and train a site representative regarding basic equipment functionality (“Train the trainer”)

- Obtain sign-off from site administrator or authorized designee; photo documentation may also be required

- Other tasks as may be required for a complete and efficient equipment set up to provide the site location with a fully functional and functioning device.

- Transport of the delivery to the secure location inside the school identified by the school administration.

Equipment

- Document camera - 100

- Document camera 2 - 300

- Collaboration endpoint 100

- Plugable dual monitor docking station - 1000

- Stereo headset with boom mic - 100,000

- Projectors - 2700

- Interactive dry erase - 1000

- Projection screens - 2000

- Interactive flat panel displays (75 and 85 inch) - 3000

- ATSC TV Converters 2000

- HDMI matrix switch - 2000

- Intergration Service - 4000

Notes

- Not a word about ADA

- Certifications generally FCC, CE and RoHS

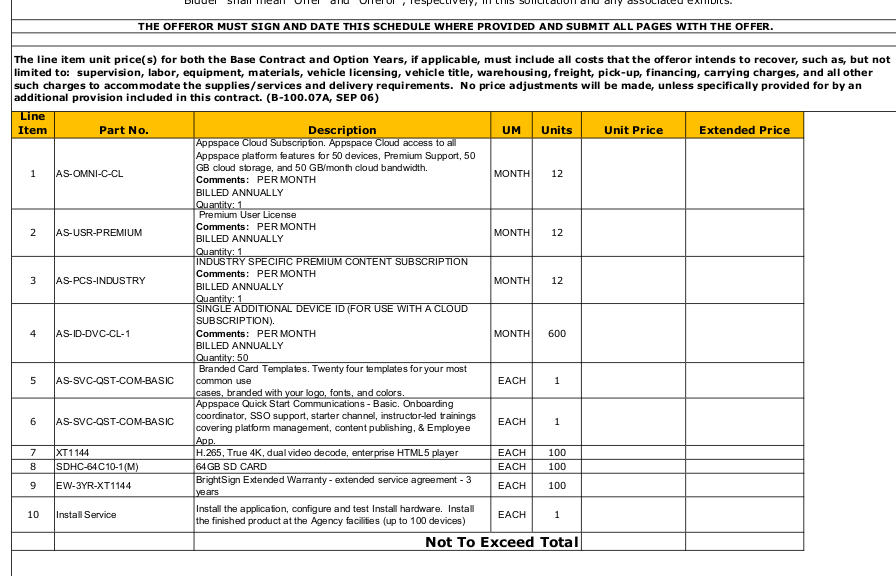

Tennessee University - proposal due 6/28/2022

10,000 students -- Tennessee Technological University (“Tennessee Tech”) is seeking proposals for an experienced and

qualified Contractor to provide a Digital Signage Solution. Tennessee Tech currently has 110 digital signs managed by 118 users across 35 buildings. The Office of Communications & Marketing manages the users, templates, and the platform in an administrative role for all departments, and Information Technology Services manages the hardware and installation of all signs.

Requirements

- 120 users and 110 signs Year 1

- Annual Maintenance year 2 thru 5

- Additional signs (10 per year) years 2 thu 5

Javits Convention Center - May 2022

The New York Convention Center Operating Corporation (NYCCOC) is soliciting proposals for an integrated commercial digital display and advertising solution for its outdoor (and potentially indoor) digital displays utilized for advertising. The winning bidder will be responsible for providing both the required displays as well as the advertising sales services, the equipment purchase, installation, and maintenance. and the traditional advertising program at the Javits Center.

Install Digital Signage - Asheville - proposals due 7/18/2022

Description of Work:

- Install wiring and power to locations of provided city owned digital signage equipment at eye level at 9 locations

- Install and label all network jacks on both sides

- Install power to the locations of digital signage at eye level

- Vendor to label port in network closet to show it is the digital signage connection

- Vendor to mount to wall and connect the Signage to network

- Vendor to correct time and location and do basic set up of signage dashboard

- Vendor to test power connections and network signal to signage,

- Vender responsible for getting all required permits

- Vendor to ok Signage angles and sights with APD staff before handoff

- Once Digital signage is installed all wiring/power must be out of sight and hidden behind device

- Vendors must have low voltage installation certification and high voltage certification or a sub contractor with the same, you will be required to show proof of current certification.

LED DISPLAY AND DIGITAL SIGNAGE SOFTWARE -- FLORIDA » PINELLAS COUNTY SCHOOL DISTRICT

Description

The purpose and intent of this invitation to bid are to select suppliers to provide, deliver, and assemble 22 interactive teleconference display monitors mounted on carts and to secure firm, net pricing as specified herein.

Bid required 1/31/2022 -- Award announce 7/7/2022

Award

Recommended Bidder : Sharp Electronics Corporation

Bid Number:22-205-163

Bid Title:LED Display and Digital Signage Software

Bid Category: LRB

Bid Term:N/A

DESTINATION / REQUESTER : Pinellas Technical College Frank Cianca

FUND/CC:Various

PROJECT/ SUB- PROJECT :Various

TOTAL CONTRACT AMOUNT:159,003.00

Please sign in or register for FREE

If you are a registered user on AVIXA Xchange, please sign in

I should add that ANSI has an Electric Vehicles Standards Panel starting up. The KMA is a participating sponsor/member and on the working groups as well. Here is all the information or you can contact me. NEVI releases $6B in funding this year (and subsequent years). Bit of a gold rush. -- https://kioskindustry.org/ev-electric-vehicles-standards-panel-sponsor/