Q3 AV Buyers optimistic about investments

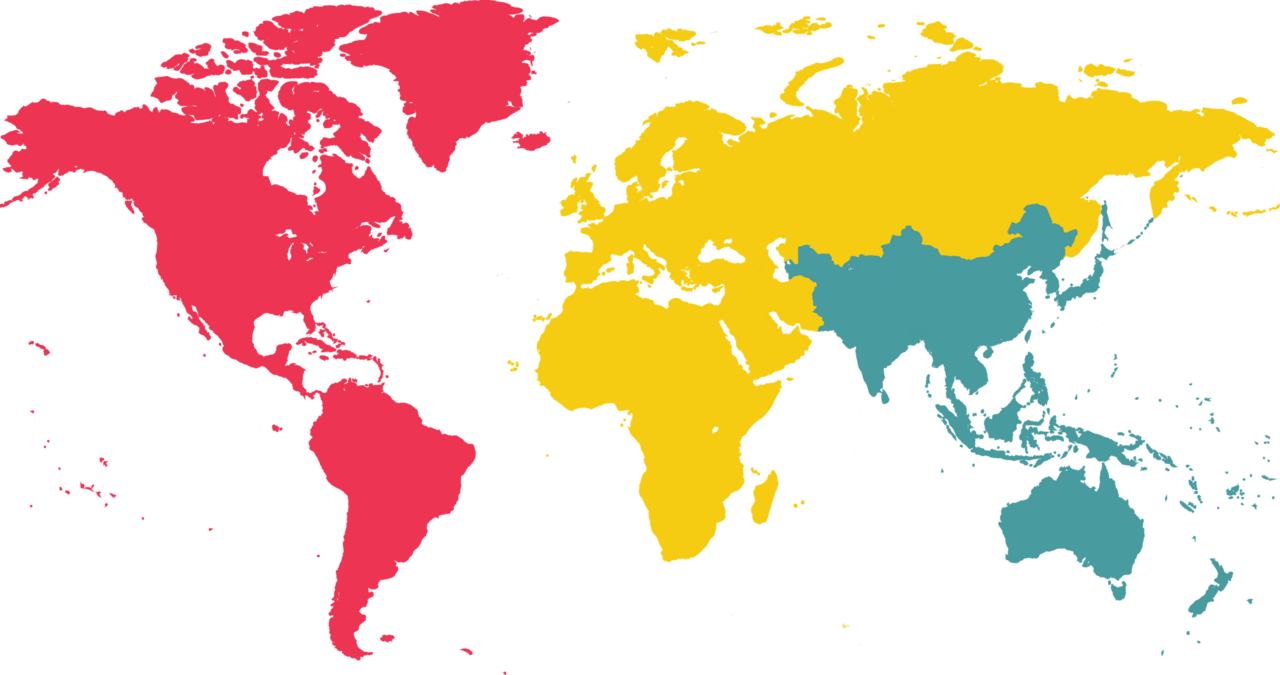

Slightly more than half of global audio visual solution buyers expect their capital budgets to increase in the third quarter, with steady spending levels for AV products and services, according to AVIXA’s Market Opportunity Analysis Report (MOAR), which included a survey of more than 2,000 global AV end users. Compared to the second quarter, the Americas recovered from a dip in growth expectation, while EMEA and APAC were still slightly down. The results can be explained by delayed post pandemic backlog clearing and economic issues in major countries, like Germany and China.

In the Americas, the US priorities included boardrooms, collaborative spaces, and workspaces signifying focus on the great office remake that is underway. Also noteworthy was an increase in AV production for broadcast, as corporate and education verticals require spaces to upgrade their AV workshops for a variety of internal and external content presentations and events.

Control rooms ranked high in Brazil, China, and India, indicating growth in scale in countries with expanding infrastructure. In Europe, AV production for broadcast fell, while large group presentation/auditoriums remained a top priority. While it’s important to not read too much into quarterly data points, anecdotal indications are that large group presentations, such as demonstration centers, are more popular in European countries who are holding off investing in more advanced content production due to the mixed economy.

The third quarter also showed a strong shift in product category priorities to standalone software. All countries, except China and the US placed software first. Video displays topped the future spend list in the US, while China focused on content management hardware. The shift to software for unified collaboration and communications, security, and control systems, with a significant shift toward feature optimization with AI, are all drivers of this trend. That said, it’s not software alone, but software and hardware, such as audio equipment, video displays and content management hardware. Software is becoming more important as an integrated enhancement and optimizer of hardware, but core Pro AV hardware platforms remain.

Planned AV upgrades in each of the top six verticals (corporate, venues and entertainment, government, education, healthcare, and retail) reflect global trends, such as collaboration and training, while each vertical also features its own space, such as stadiums and sports arenas in venues, patient exam and procedure rooms in healthcare, and sales floors and kiosks in retail – each requiring specialization in the category.

From a product perspective, the prominence of software was reflected in the survey results, led by corporate, healthcare, and retail, alongside the continued importance of audio equipment, video displays and projection. Capture and production equipment, content management hardware and infrastructure were also among the top five for the key markets. The Pro AV solution set represents a wide array of products requiring cross-industry partnerships to address vertical market needs. That said suppliers should take note an increase in standalone software is on the horizon.

Please sign in or register for FREE

If you are a registered user on AVIXA Xchange, please sign in