How will Pro AV fare in the tariff fog?

In February, the United States launched an additional 10% tariff on China and a 25% tariff on steel and aluminum for more than nine countries, including allies and close trading partners. More tariffs are likely to be announced. Many tariffs that are announced have been delayed or limited through exceptions. In any case, the new tariff policy has created economic uncertainty, essentially a fog dampening business cycles across most industries. Pro AV is no exception.

These developments explain why we made tariffs the focus of the 2025 Q1 META Report. That report (which we briefly summarized here) explains why we see tariffs as a key issue for the four years of the Trump Administration, how companies were initially responding, and what strategies firms can use to deal with them. To highlight a number about initial responses, the report revealed that 20% of Pro AV manufacturers surveyed in a January poll were stockpiling products to minimize tariff impacts.

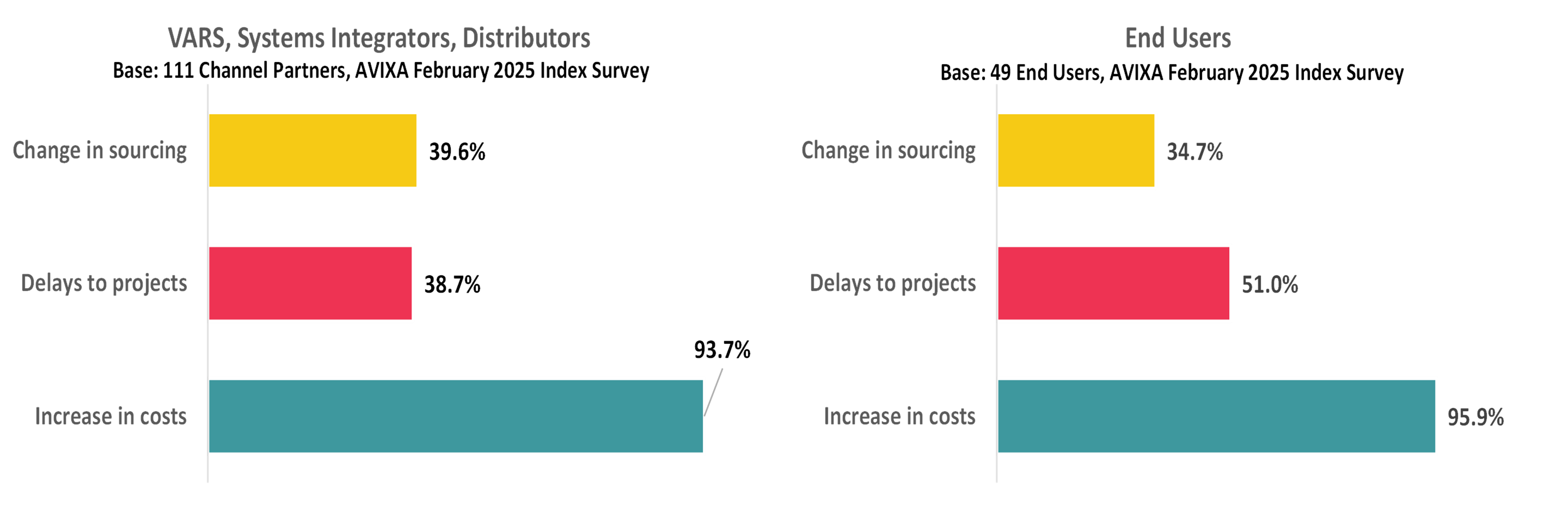

Since then, Pro AV companies have become more alert and responsive to the threat of new tariffs. AVIXA’s February Index Survey revealed that most North American channel participants expect tariffs to increase their costs and about half of end users surveyed expect them to cause project delays.

The North American channel partners further stated they were very likely (65.4%) or somewhat likely (25%) to pass the increase cost of tariffs on to customers by raising prices. The most impacted areas are expected to be audio equipment, video displays, and control-collaboration product segments.

Beyond North America, more than 80% of international channel partners also expect tariffs to increase their costs and delay projects (34.5%), while many also expect a change in sourcing (30.4%).

Already facing slow growth in 2025, especially in corporate and education markets, according to AVIXA’s preliminary IOTA research, the tariff fog will further delay revenue growth as users determine if and when they will face higher costs. Channel pricing will also be unstable due to inconsistent tariff policy implementation.

The effects are not all bad. As pointed out in the META report, firms can engage in strategies that increase their competitiveness in the face of tariffs. For example, a company may be able to structure a product to be less sensitive to tariffs through alterative sourcing strategies or offering it for rental or as a service. Finding a way to lower product costs may be key to maintaining or gaining market share.

For now, increasing supply chain visibility to understand tariff risks is a key starting point. This analysis should include when, where, and how tariffs are applied and whether there are alternatives to avoid them.

Firms need to stay agile and have a tariff response strategy that is ready to go, as implementations will happen suddenly with little time for adjustment. Preparedness will allow firms to take advantage of price shifts that can lead to increased share.

The tariff fog is likely to shroud many business purchases and investment plans for the next four years. Firms need to make it part of their business strategy by doubling down on their risk analysis initiatives and sourcing-efficiency projects.

Please sign in or register for FREE

If you are a registered user on AVIXA Xchange, please sign in

I really enjoyed your presentation at the AV Trends IOTA INFOCOMM Luncheon. It was insightful and offered a clear perspective on where the industry is headed and how it’s evolving. Thanks for sharing such valuable insights.