Cineplex sells Cineplex Digital Media to Creative Realities for $70M

Cineplex Sells Cineplex Digital Media to Creative Realities for C$70M: What It Means for DOOH and Retail Media

Cineplex Inc. has agreed to sell its digital place-based media arm, Cineplex Digital Media (CDM), to U.S. signage provider Creative Realities Inc. (CRI) for C$70 million in cash. Cineplex frames the move as a strategic refocus on core entertainment operations and balance-sheet repair, while CRI calls it a transformational acquisition that doubles its size and expands its North-American reach.

Key Deal Highlights

-

Purchase price: C$70 million cash, subject to standard adjustments.

-

Timing: Expected to close late 2025 pending regulatory approvals.

-

Post-sale partnership: Cineplex remains the exclusive advertising-sales agent for CDM-operated DOOH networks in Canada.

Why Cineplex Is Selling

CDM has been an award-winning B2B signage arm serving retail, QSR, and entertainment venues. Yet Cineplex’s post-pandemic strategy pivots toward theatre experiences and cash-flow improvement. Proceeds will likely support debt reduction, share buybacks, and select experiential investments.

Why Creative Realities Is Buying

For CRI, the deal delivers:

-

Immediate Canadian scale and new vertical coverage.

-

Cross-sell potential in software, services, and AdTech.

-

Forecasted synergies of ~US$10 million annually by 2026 through integration and operational efficiency.

Industry Context: The DOOH Consolidation Flywheel

This sale underscores a wave of cross-border consolidation in digital signage. Growth now depends on platform scale (hardware lifecycle, managed services, CMS integration) and media scale (audience metrics, unified ad operations). Expect CRI + CDM to rationalize software stacks, align SLAs, and craft a broader retail-media network story for advertisers.

Competitive Landscape

Unlike peers using Scala, Poppulo/FWI, Omnivex, Navori, or Signagelive, CDM built largely on proprietary tech, occasionally integrating Broadsign for publishing and monitoring. That home-grown capability—combined with Broadsign and signageOS—gives CRI not just assets but an established CMS + analytics ecosystem.

What to Watch

-

Integration roadmap: Will CRI unify around ReflectView + AdLogic, or maintain dual tracks with CDM’s FLEX suite?

-

Advertising continuity: Cineplex’s retained ad-sales role ensures stability for Canadian media buyers.

-

Financial deployment: Look for Cineplex’s next capital-allocation move—debt vs. expansion.

-

Execution risk: Cultural integration, client retention, and platform migration could all shape early results.

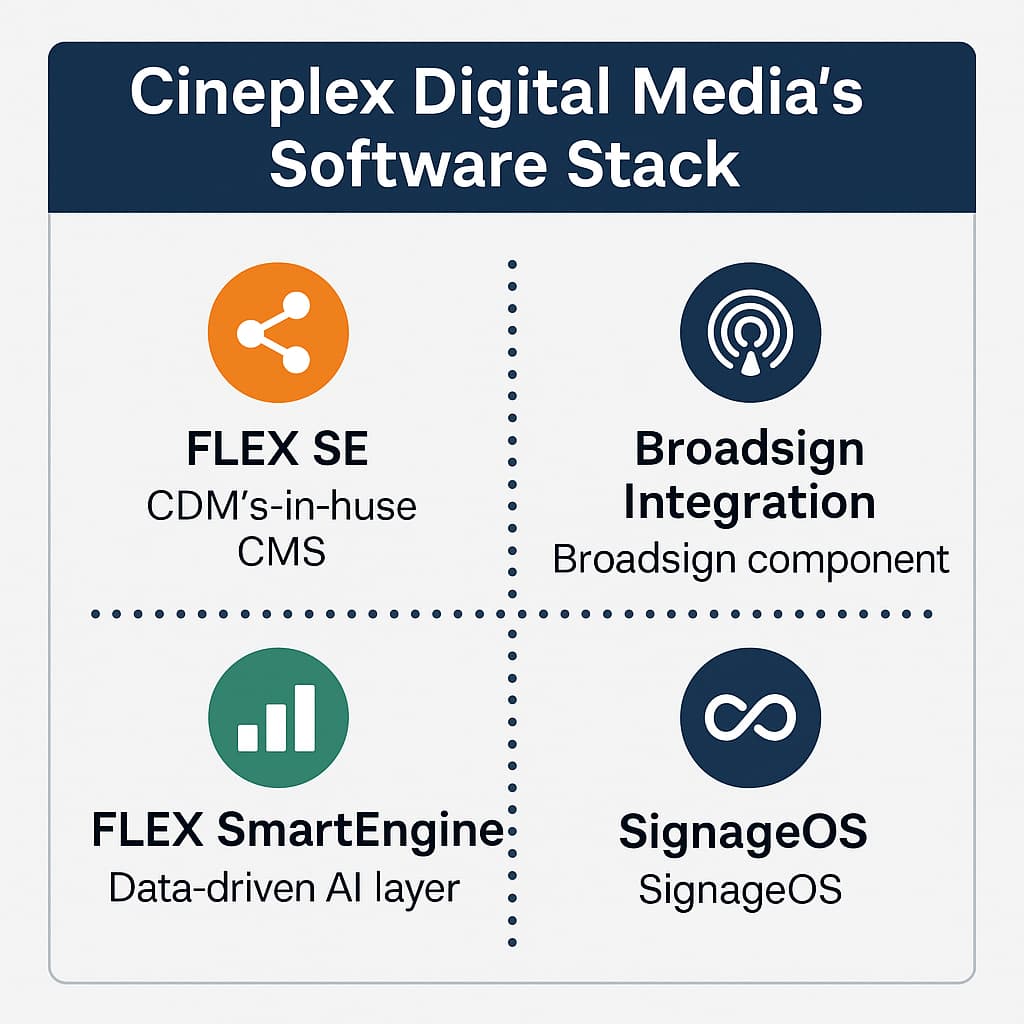

Sidebar: Cineplex Digital Media’s Software Stack

Cineplex Digital Media (CDM) built much of its signage network on its own proprietary platform:

- FLEX SE (CMS): In-house content-management system for multi-location retail/QSR.

-

FLEX SmartEngine: AI-driven content optimization based on audience/context data.

-

Broadsign integration: Used for publishing/device management.

-

signageOS: Back-end visibility layer for hybrid environments.

This mature stack means CDM’s worth lies as much in software intelligence as in screen networks—a key reason CRI views the acquisition as transformational.

Perspective & Takeaway

For AV professionals, the deal highlights how signage value now hinges on software depth and data interoperability.

For advertisers, it promises a unified North-American DOOH footprint with consistent measurement.

For investors, it marks a shift: Cineplex trimming non-core assets to fortify its entertainment base, while CRI bets on scale and analytics to command a premium in the retail-media ecosystem.

Sources

- Creative Realities news release

- Cineplex announcement (via Yahoo Finance)

- Boxoffice Pro coverage

- Digital Signage Today

More Cineplex Creative Realities Related

Deeper Dive with AI

Cineplex Digital Media (CDM) mainly ran on its own signage stack, but there’s credible evidence they also used Broadsign components (and integrated with SignageOS) in parts of the operation. Zero public proof they standard-ran other third-party CMSs across their networks.

What’s documented publicly

1) CDM’s own CMS/platform

-

FLEX SE (CMS) — CDM’s in-house content management system positioned for multi-site retail/QSR deployments. cdmexperiences.com+1

-

FLEX SmartEngine — their data/ML layer that personalizes and optimizes content in real time. cdmexperiences.com+2mediafiles.cineplex.com+2

Implication: A lot of CDM’s networks likely ran on this proprietary combo (FLEX SE + SmartEngine), which is part of the value Creative Realities is acquiring.

2) Broadsign in the stack (publishing & ops)

-

A CDM-branded Broadsign Publish login endpoint exists (

go.cdmpublish.com), which strongly suggests CDM used Broadsign’s platform (at least for some publishing/workflows). go.cdmpublish.com -

A recent ReadyWorks case study about “the digital signage team” at Cineplex mentions integrations with BroadSign and SignageOS for device visibility and compliance — again indicating Broadsign was in the tooling mix. readyworks.com

Implication: Even with an in-house CMS, CDM appears to have leveraged Broadsign (and SignageOS) for parts of the network lifecycle — e.g., player management, publishing flows, or media side operations.

What I did not find good evidence for

-

No reliable, first-party or trade-press confirmation that CDM standardized on Scala, Poppulo/Four Winds Interactive, Omnivex, Navori, Signagelive, etc., for its retail/cinema networks. Lots of those vendors market to cinema/retail, but we couldn’t verify a CDM deployment with them. (Some articles you’ll find are about other venues or general cinema signage, not Cineplex/CDM specifically.)

Please sign in or register for FREE

If you are a registered user on AVIXA Xchange, please sign in